Information About the Litigation Against BrainTap, Inc., Patrick Porter, and Cynthia Porter

On December 16, 2024 a group of investors and former executives filed a lawsuit in the United States District Court in Delaware against BrainTap, Inc. and its husband-and-wife founders, Mr. Patrick Porter and Ms. Cynthia Porter. This site provides publicly available information about that lawsuit. The investors represent a majority of the ownership of BrainTap, excluding the Porters.

“Angel and startup investing is critical to the economic lifeblood of the United States as technology-enabled companies represent most of the growth in the U.S. economy and one of its remaining durable advantages. One of the greatest barriers to the continued growth of this sector is the endemic fraud committed against angel and early-stage venture investors, which almost always occurs without consequence. This action is brought by a group of successful and seasoned angel and venture investors to say categorically that securities fraud and breaches of fiduciary duty have no place in the startup world.” (Complaint ¶ 4)

Public Documents

The Complaint

The Complaint contains 15 causes of action, including Federal Securities Fraud, State Fraud, Breach of Fiduciary Duties, and Defamation. Highlights are below.

Exhibits to the Complaint

The Complaint contains a number of Exhibits, including tax records signed under penalty of perjury which contradict court filings by BrainTap.

Highlights from the Complaint

The Complaint is a detailed 63-page document and any summary necessarily omits important details. The summary below is qualified by the Complaint (linked above) and the attached paragraph numbers are included as an aid to finding key sections, even though many facts show up in multiple places in the Complaint.

Background and the Parties

The husband-and-wife team of Patrick Porter and Cynthia Porter lured investors to invest million of dollars into BrainTap, promising to transform it from a “mom & pop” operation to a professional venture-backed company for exit in 2-4 years. Despite the initial rapid growth under a professional CEO, the Porters continued to operate the Company as their own personal and family “ATM,” extracting millions of dollars of corporate assets for the benefit of themselves and their family members, and they proposed or attempted schemes that bordered on or constituted illegality. When the professional CEO and outside legal and accounting firms tried to stop these actions, the Porters fired the CEO and the outside professionals, leaving a clear path for their wrongdoing. As a result, the technology suffered and the Company’s value plummeted. (¶¶ 1-2)

Plaintiffs are successful businesspeople and investors, including former trustees of major universities, business school and entrepreneurship professors, professionals, technology executives and innovators, international business specialists, angel and venture capital investors, and a former decorated military veteran who invested to help veterans who suffered from PTSD. (¶¶ 10-22)

Defendants are BrainTap, Inc. and the husband and wife team of Patrick and Cynthia Porter. Mr. Porter styles himself as “Dr. Porter” and routinely makes medical and scientific claims about the BrainTap technology, even though his degree is in “Counseling Psychology” from Louisiana Baptist University and Theological Seminary and he is not a medical doctor. Mrs. Porter claims a Ph.D. which her university cannot verify. The Porters control the BrainTap Board of Directors and owe fiduciary duties to the Company’s stockholders. Mr. and Mrs. Porter also had a previous Chapter 7 bankruptcy which they failed to disclose to investors. (¶¶ 25-36)

The Porters Terminated a Professional CEO to Cover Up Wrongdoing

Mr. and Mrs. Porter induced a professional CEO, Nicholas Zaldastani, to join the Company, using many false promises. When Mr. Zaldastani tried to implement controls to stop the Porters from misusing Company assets and tried to stop potentially illegal behavior, Mr. and Mrs. Porter terminated his employment and used fraudulent claims, including making knowingly false allegations to a state court, to try to take back his equity in the Company. (¶¶ 37-73, 156-66)

The Porters Concealed Side Agreements and Their Terms

Mr. and Mrs. Porter created and concealed side agreements. These side agreements permitted Mr. Porter to terminate his intellectual property license agreement for his content to the Company. The terms of these side agreements were never disclosed to investors verbally, in writing or, as required by its explicit terms, in the stock purchase documents. (¶¶ 74-92)

The Company Misled Investors Regarding Its Intellectual Property Rights

The Company and Mr. and Mrs. Porter also misled investors regarding the creation of key intellectual property. For example, Mr. Porter did not independently develop all of the intellectual property he claims to have developed, the Company does not have ownership rights to key pieces of technology necessary to operate, and failed to license certain technology. Nevertheless, Mr. Porter continues to make aggrandizing and false statements in public appearances and to investors about the Company’s IP rights and his role in their creation. None of these facts were disclosed to any investor, even though the Company was obligated to disclose all such issues regarding intellectual property ownership under the stock purchase agreement. (¶¶ 93-97)

Mr. Porter Took False Credit for Content to Misappropriate Company Funds

Mr. Porter attributed to himself improper credit for hundreds of pieces of content in the library, allowing himself to receive additional and undeserved royalties without oversight of the normal expense approval process. Mr. Porter tagged himself as an authorized royalty recipient on hundreds of tracks in the Company’s library, despite his not having written the script for those tracks or voicing those tracks. Indeed, Mr. Porter even tagged himself to receive credit on tracks created by a creator who died as well as on tracks which belonged to the Company. This scheme allowed Mr. Porter to divert hundreds of thousands of dollars, possibly millions of dollars, to himself improperly. The scheme worked because Mr. Porter had sole oversight of the royalty payments. (¶¶ 98-101)

Mr. Zaldastani tried to remove Mr. Porter from the role of oversight over royalty payments since Mr. Porter was the primary beneficiary. However, Mr. and Mrs. Porter used their positions as the majority of the Board to thwart any such oversight. The Company’s external accounting firm repeatedly raised to management the magnitude of the royalty payments and the lack of backup supporting documentation and oversight. Rather than submit to questions about external audits and independent confirmation of calculations, Mr. and Mrs. Porter ultimately terminated the relationship with the external accounting firm and returned accounting functions to a family member on the Company payroll to cover up wrongdoing. (¶¶ 99-105)

Other Misappropriation of Corporate Funds

Mr. and Mrs. Porter’s pattern of misusing corporate funds did not end with the improper royalty scheme. For example, Mr. and Mrs. Porter charged to the Company expenses for a personal trip to Europe to celebrate their anniversary. As another example, while on a trip to Las Vegas, Mr. Porter charged to the Company expenses he incurred at the Sapphire Strip Club, billed as “the world’s largest strip club.” (No Company business was conducted there.) (¶¶ 106-10)

When Mr. Zaldastani tried to stop Mr. Porter from paying himself, Mr. Porter refused to cooperate. The actions by Mr. Porter were so severe that the outside accounting firm sent a message to the BrainTap management team expressing concern. The message stated “We need to ensure that there are no more personal transactions billed on the business credit cards and even recommend disconnecting those feeds from [QuickBooks]…. As you move to a C corporation and the need to meet GAAP reporting guidelines and, potentially, audits, if these expenses are co-mingled, you risk not only severe tax implications, but also a misrepresentation of the health of the business.” (¶ 111)

Mr. Porter continued to reimburse himself with no oversight despite these attempted interventions from the Company’s independent accounting firm. For example, in May 2021 after Mr. Porter failed to comply with documentation requirements following the outside auditor letter, Mr. Porter wrote, “OK, I am super pissed. WTF on my reimbursement. Don’t treat me like a staff person goddammit…. The letter from the Bookkeepers is way out of line. You reimburse and then we work out the details.” (¶ 112)

Mr. Porter was so dissatisfied with the attempted financial controls that he gave himself full admin read and write access to the Company’s QuickBooks account, which enabled him to make changes. This unilateral change outside of normal financial controls caused the outside accounting firm to express concern that they would be unable to stand behind financial statements since Mr. Porter could make changes without any review, oversight, or checks. (¶ 113)

Eventually, Mr. and Mrs. Porter removed the outside accounting professionals who expressed concern and housed the finance function inside the Company with one of their relatives. (¶ 113)

Nepotism

Mr. and Mrs. Porter used the Company and investor money to support various family members who were largely unqualified to hold the positions they occupied, and which, in some cases, were used to cover up wrongdoing. The Company employed Mr. Porter’s sisters, brother, as well as his sister-in-law and three of her daughters, along with nieces and nephews. Members of the executive team were told by Mr. Porter that they could not object to the hiring of family members. (¶¶ 119-22)

Mr. Porter not only used the royalty payments, over which he had complete control, to direct payments improperly to himself, but also to family members without oversight or accountability. For example, Michael Porter, Mr. Porter’s brother, received monthly royalty payments of $6,000. The outside accounting firm tried to make calculations to justify this payment based upon session counts, but was only able to justify approximately 1/6 of the amount Michael Porter was actually paid. The outside accountant said that the “session counts don’t add up to anything close to what [Michael Porter’s] getting,” the “math counts” do not work for his calculations, and characterized the payments to Michael Porter as “some kind of backdoor deal.” The outside accounting firm even speculated that there might be potential criminal liability for these payments. In other words, the royalty accounting system operated as a family “slush fund” so that Mr. Porter could skirt any controls on diverting money to himself and family members without oversight. (¶¶ 123-26)

Violations of Laws

In addition to the securities fraud described in the Complaint and a scheme to commit tax fraud, Mrs. Porter attempted to hire an unregistered broker dealer to illegally raise funds for BrainTap. Upon learning of this, Mr. Zaldastani contacted Company counsel and received an opinion that such actions were improper and potentially could result in criminal penalties and result in claims against the Board members for breach of fiduciary duty. Mr. Zaldastani shared this opinion with the full Board. Despite the illegality and opinion from Company counsel, Mrs. Porter insisted that it was acceptable to proceed with raising funds with an unregistered broker dealer. (¶¶ 128-36)

Mrs. Porter Violated Her Duties as Secretary

Mrs. Porter has a series of legal duties not only because of her position as an officer and director of BrainTap, but also because of her position as Secretary. Mrs. Porter failed to document actions of the Board that Mr. Porter and she later wanted to pretend never happened, or destroyed those notes and records after the fact. The Board often met weekly or multiple times a month. Despite this, Mrs. Porter frequently never took notes nor circulated minutes afterward. Mr. Zaldastani complained about the lack of appropriate documentation and the informal nature of many of the meetings, but his requests to ensure proper documentation of corporate actions were ignored. Indeed, Mr. and Mrs. Porter would use their own lack of record keeping to pretend corporate actions and discussions they approved never occurred. Indeed, it is likely that most meetings were never documented by her at all or that records and minutes were later altered or destroyed to hide valid approvals which Mr. and Mrs. Porter later wished to deny. (¶¶ 137-41)

Broken Equity Promises

Mr. and Mrs. Porter made many promises to provide equity to service providers, employees, and strategic partners, but failed to keep its promises. In the one case where it did issue equity, to Mr. Zaldastani, it initiated a fraudulent court action to try to pretend that stock was never issues and that they had no awareness of it. (¶¶ 142-55, 195-202)

Mr. Porter’s Unilateral Decision to Destroy the Working BrainTap App

After Mr. and Mrs. Porter terminated the employment of Mr. Zaldastani, Mr. Porter, without any oversight, advice, or authorization of any technical personnel, logged into the Company’s Amazon Web Services (“AWS”) account and manually deleted the BrainTap app entirely. He also killed the AWS keys, reversing any way of recovering from the decision to delete a live and working app. When Mr. Porter panicked and tried to seek technical assistance to reverse what he had done, he dissembled and initially tried to deny that he was responsible for these actions. However, he later admitted that he was the one who deleted the app and keys. At the time Mr. Porter manually deleted the Company’s existing app and keys, a replacement app was neither finalized or tested. Mr. Porter therefore deleted the only working version of the Company’s app. The deletion of the app caused a significant disruption for users using and attempting to download the app, as actions by Mr. Porter caused the app to become non-functional immediately. Rather than admit that he unilaterally destroyed a working app by disabling its keys and deleting it, Mr. Porter falsely claimed that the issues were the result of Mr. Zaldastani and its former outsourced technical team. Mr. Porter has never admitted publicly what he actually did to cause this catastrophic service interruption. (¶¶ 167-75)

Defamation of Mr. Zaldastani’s Name and Reputation

Mr. Porter’s campaign of defamation against Mr. Zaldastani is a rich history of false and harmful statements that have damaged and continue to damage Mr. Zaldastani. Among other things, Mr. Porter falsely accused Mr. Zaldastani of responsibility for the Company’s service outage (the results of Mr. Porter’s own technically negligent actions), as well as of defrauding the Company, making the Company unprofitable, breaching his fiduciary duties, spending money without approval, making a pledge to Duke University without authorization (despite Mr. Porter himself signing the pledge), and stealing Company funds. The Company also breached many agreements with Mr. Zaldastani. (¶¶ 176-94, 215-18)

Violations of Corporate Obligations

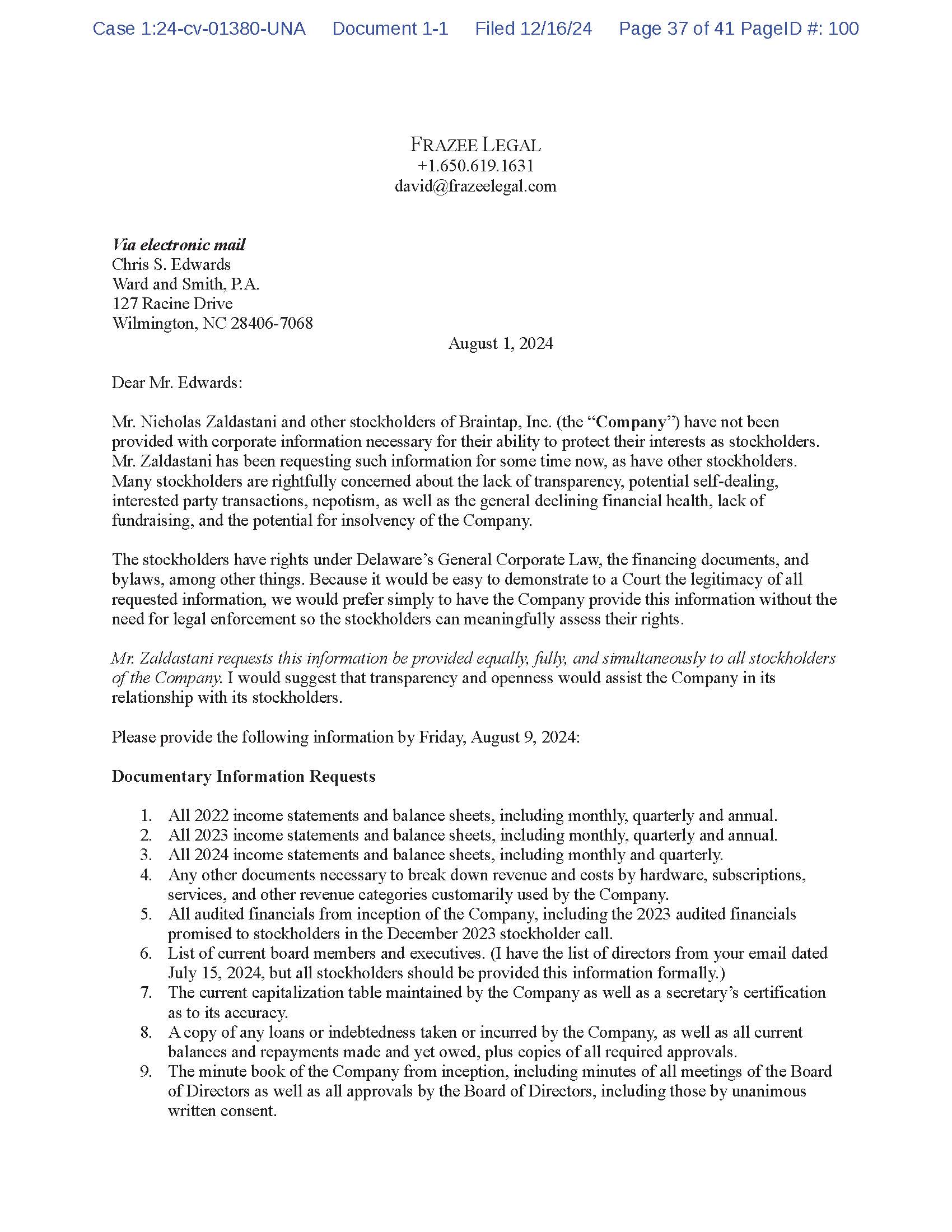

BrainTap, Inc. and the Board have failed to comply with numerous legal obligations and also have caused and approved the misuse of corporate assets. The Company has failed to have any required stockholder meetings, it failed to follow required procedures to elect its Board, it engaged in corporate transactions without required stockholder approval, and failed to provide requested information to stockholders. Indeed, it showed an aggressive hostility to its investors legitimate concerns. One director even said that if the stockholders tried to protect their rights, he would hire lawyers in Los Angeles, Miami, and New York, who would all “get together and f*** [the stockholders] up.” (¶¶ 203-10, 210-29)